Sales Tax on the Internet-The Impact Moving Forward

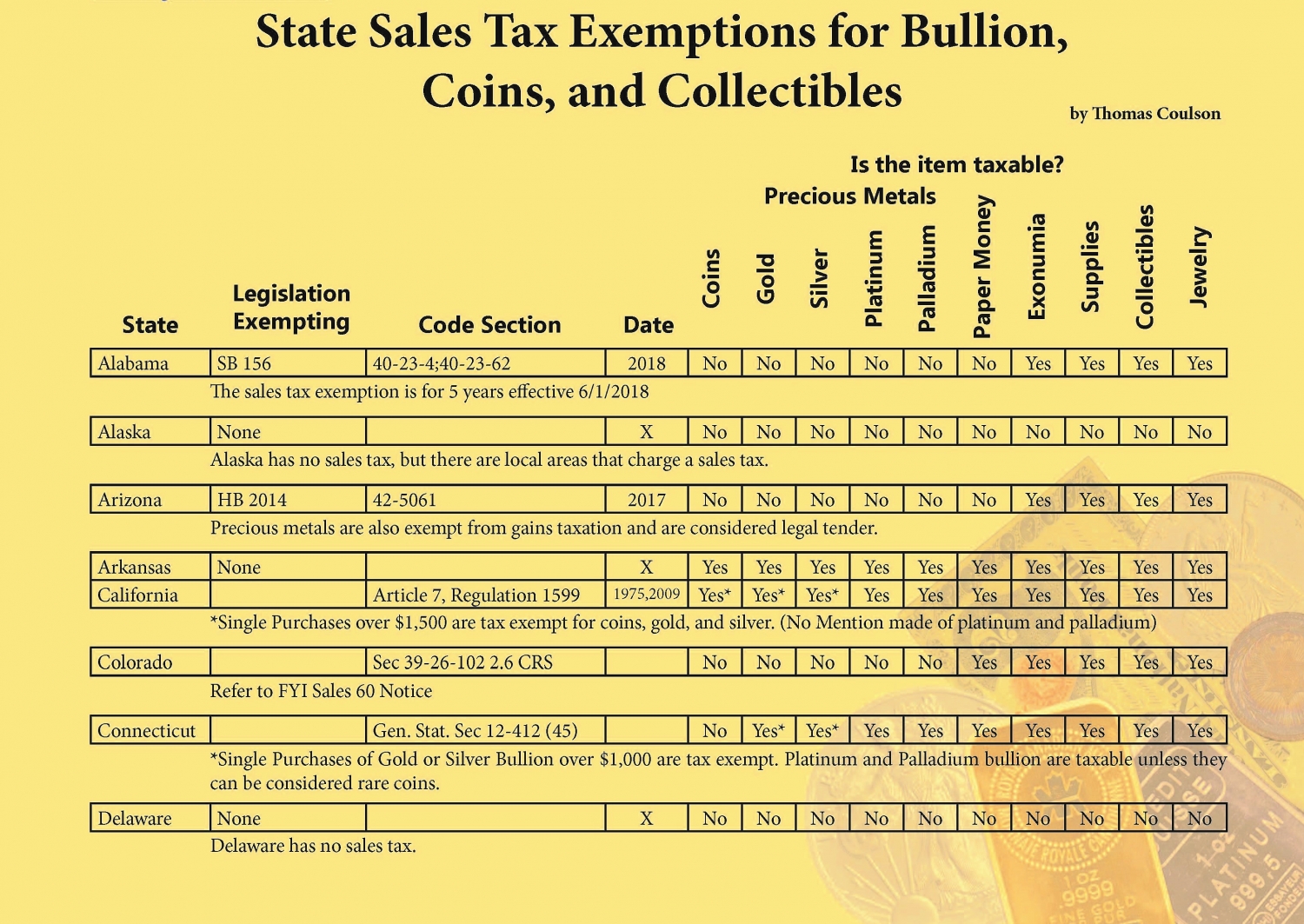

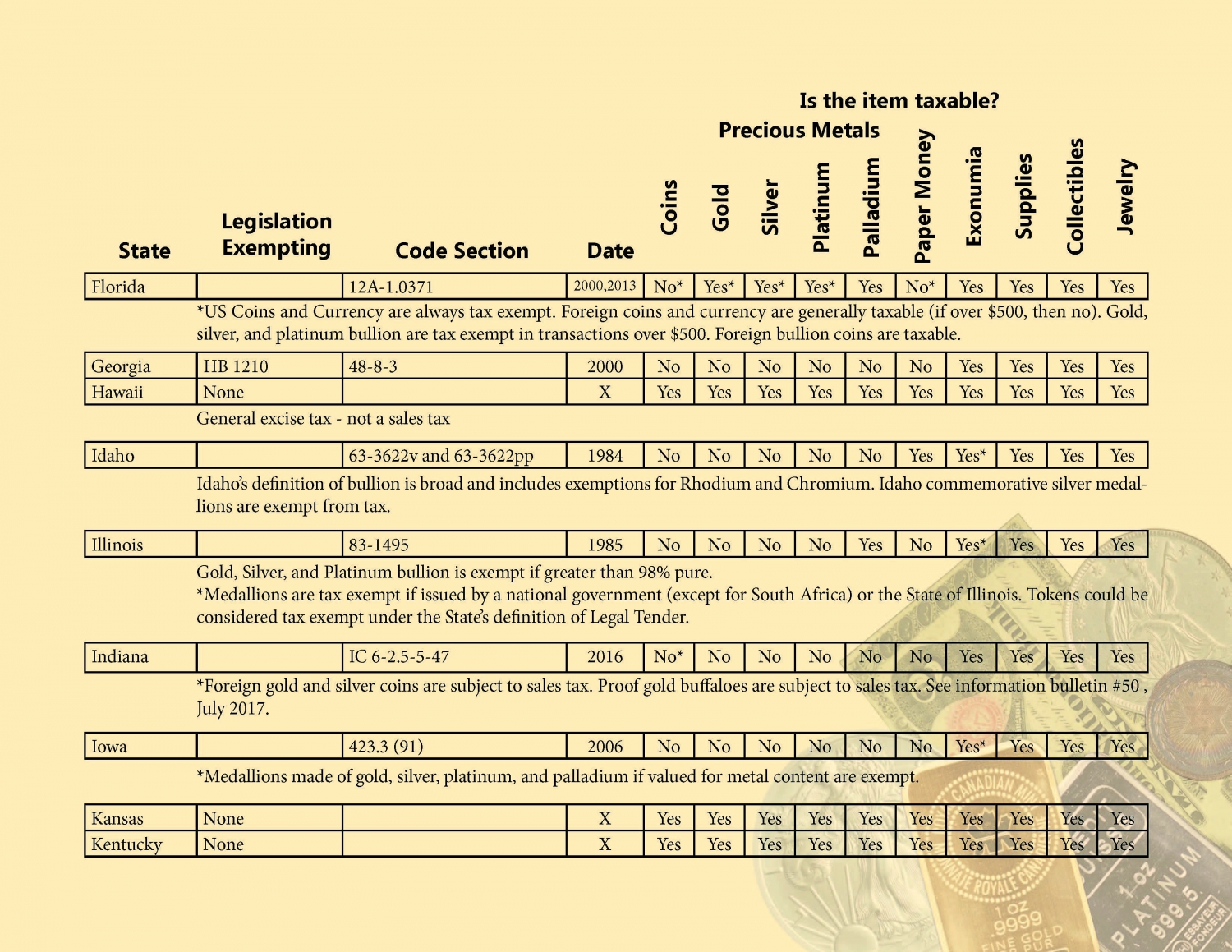

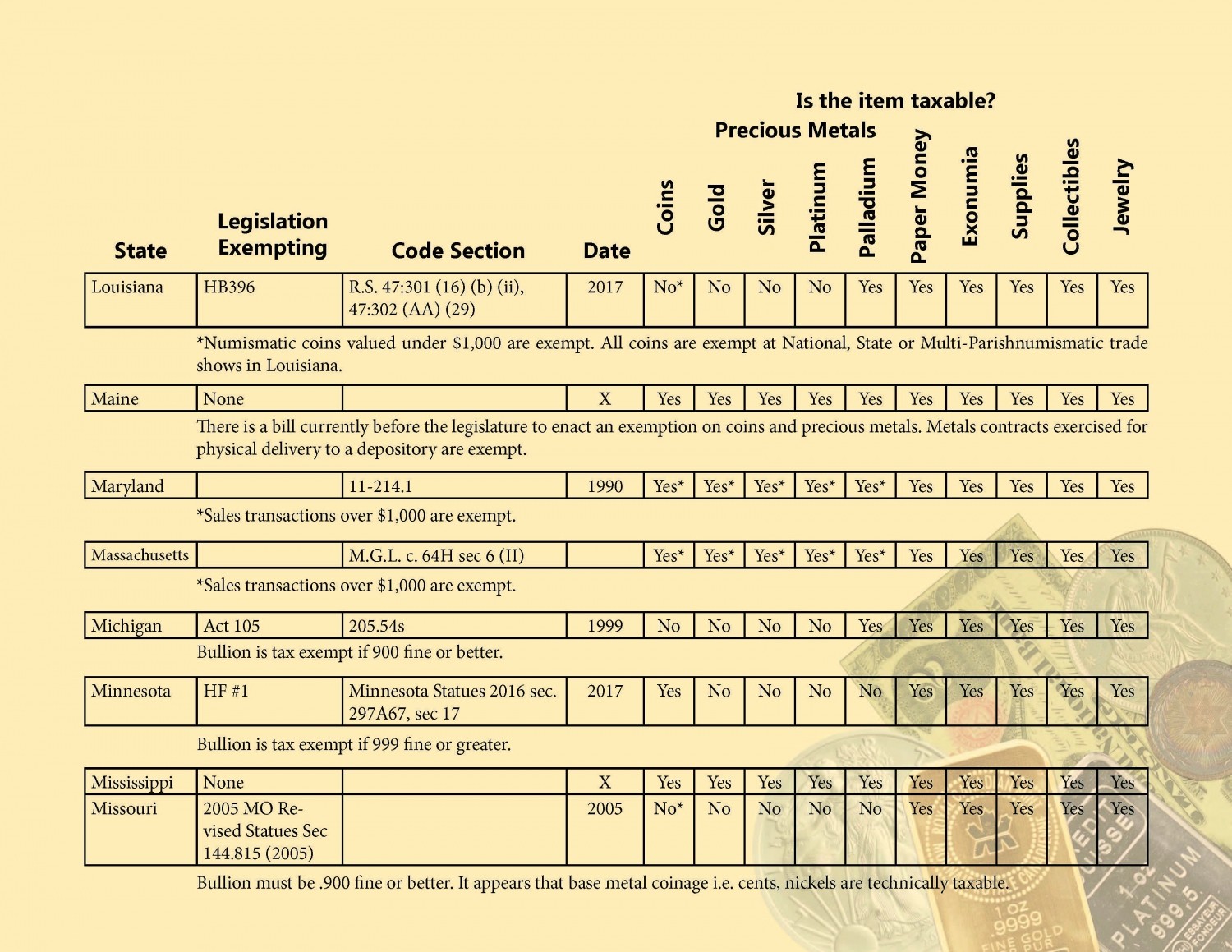

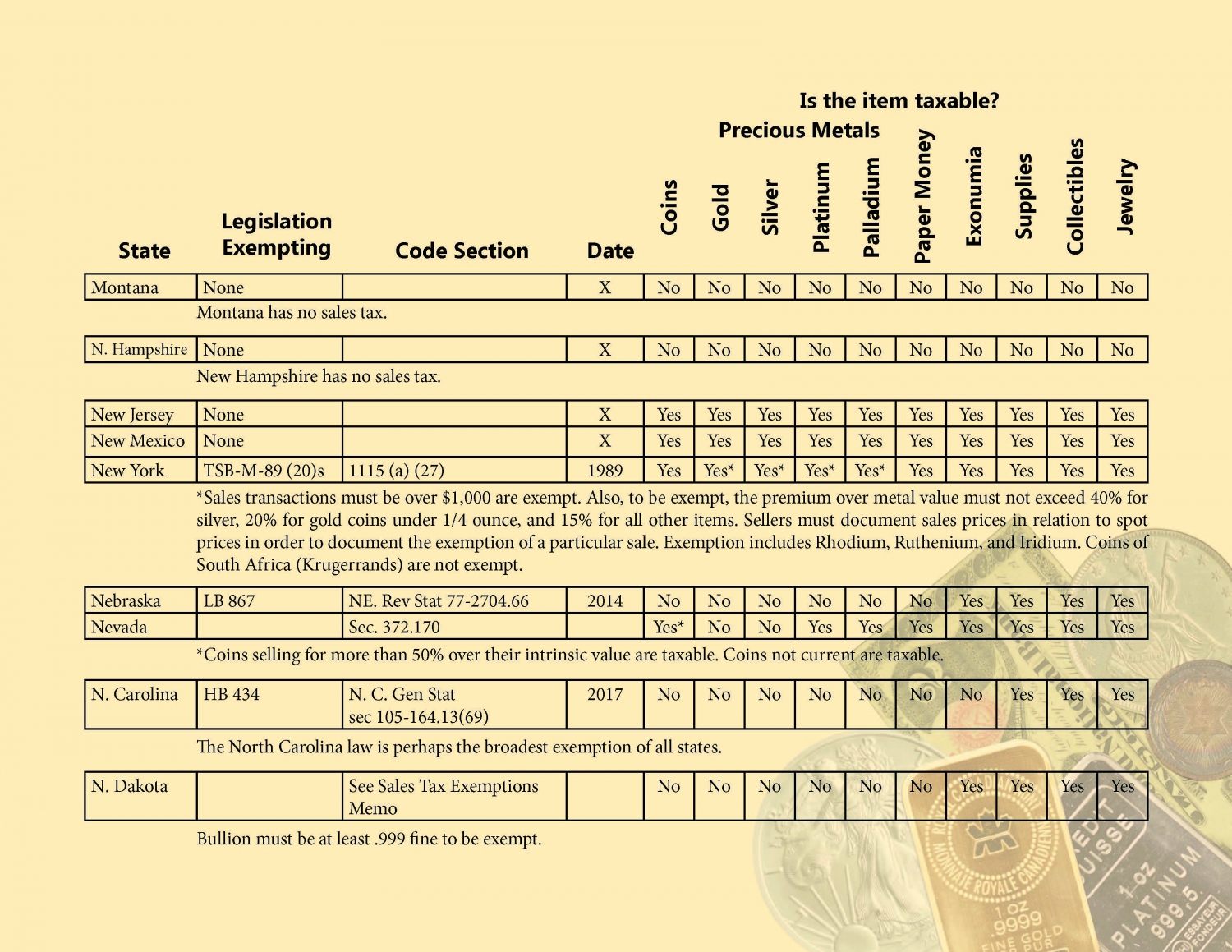

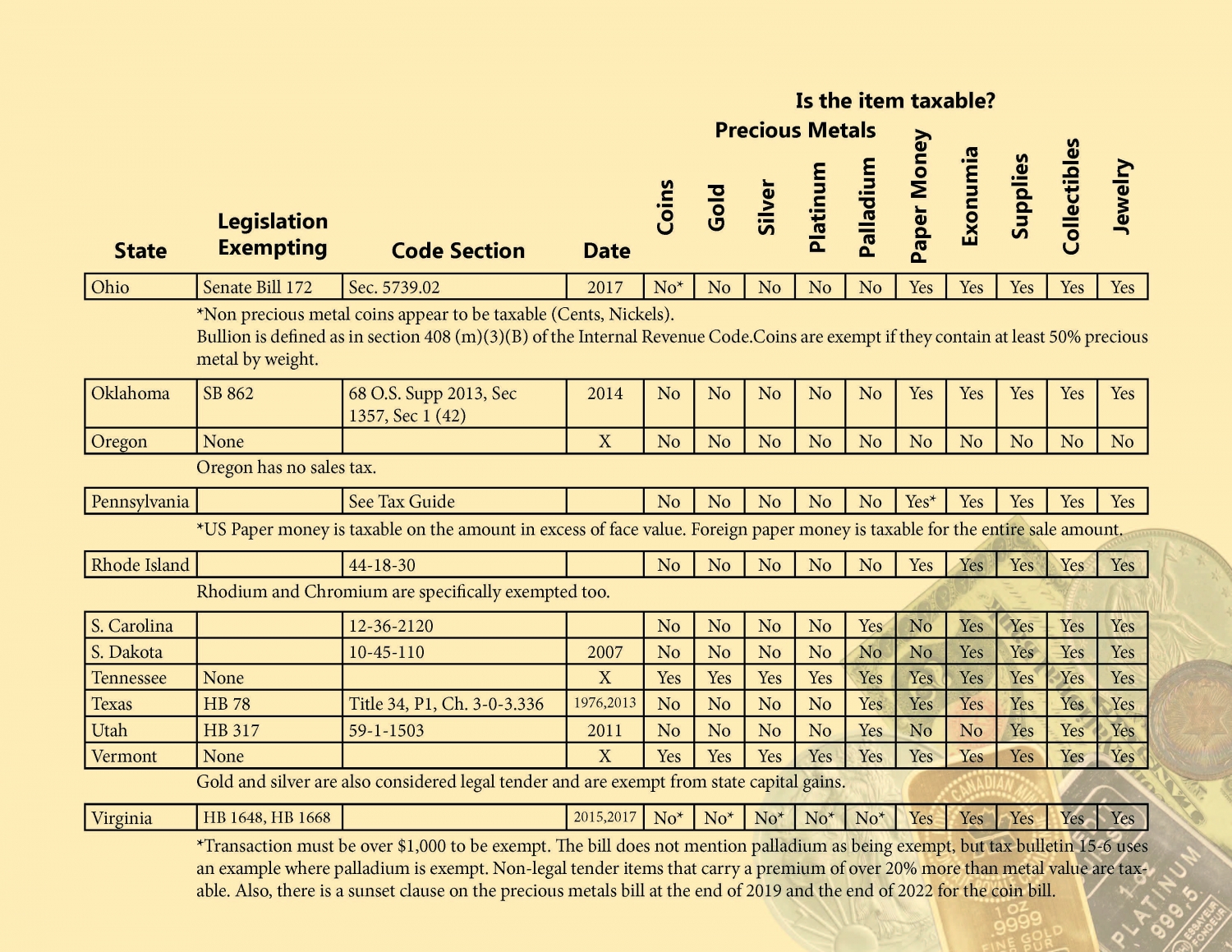

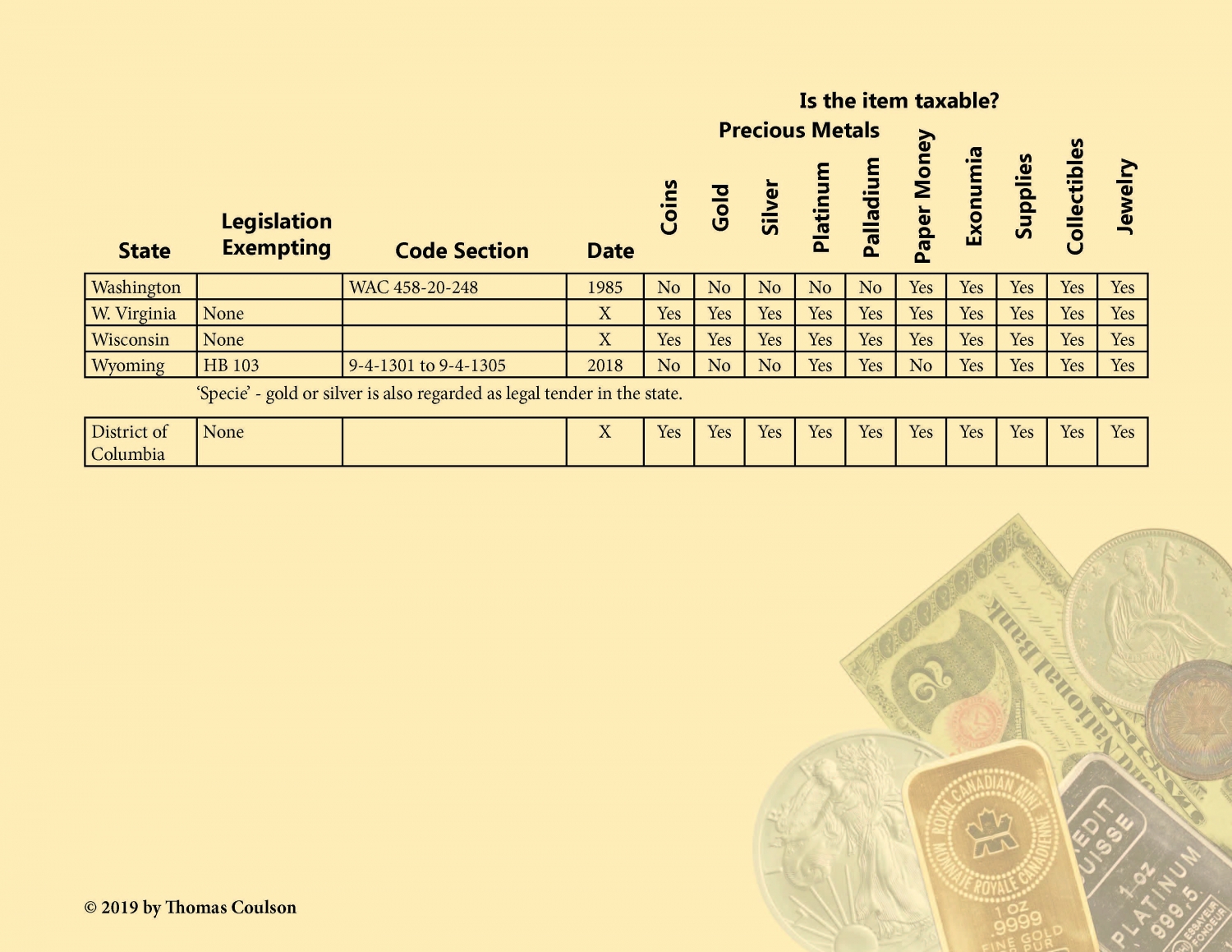

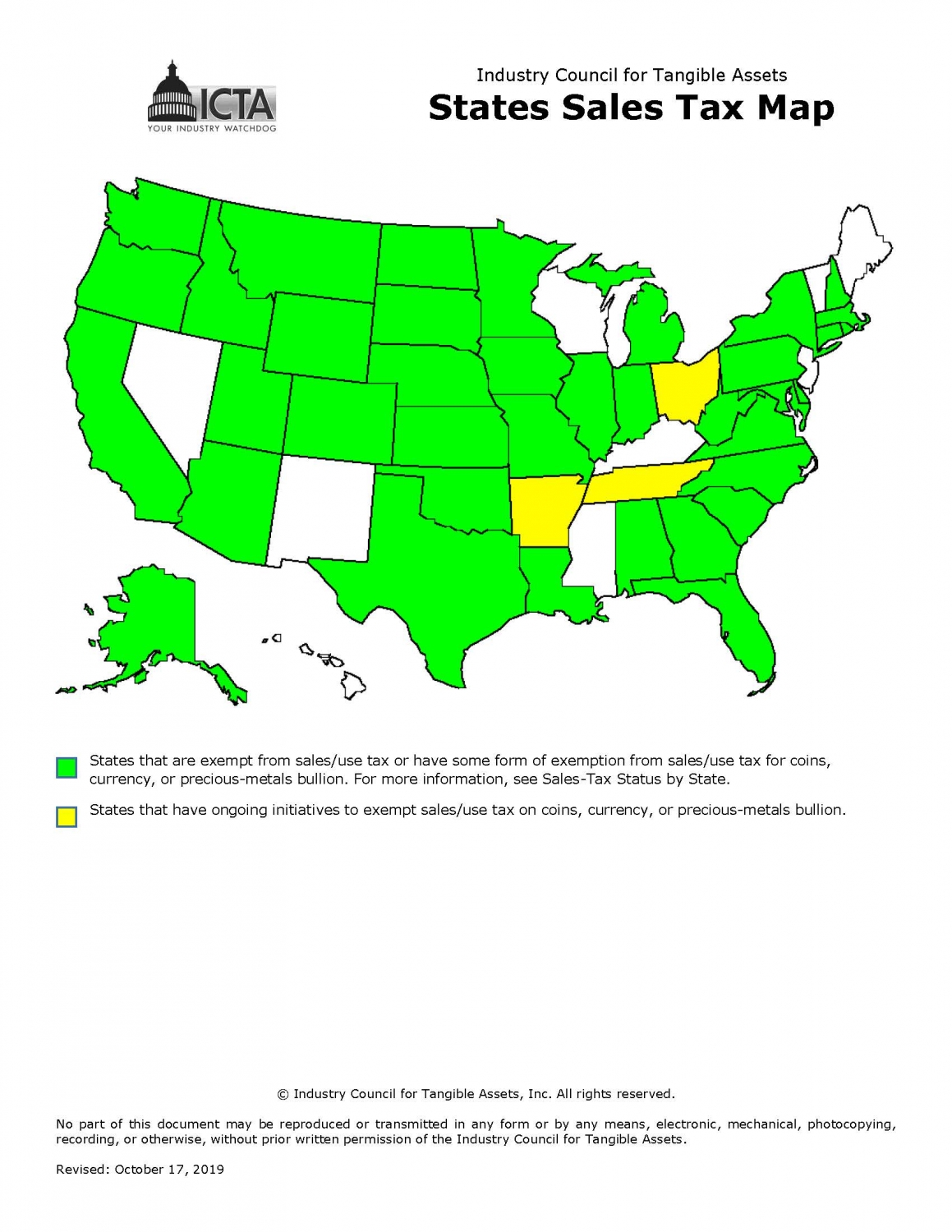

Business is never without challenges. The latest we have been dealing with is the taxing of rare coins. South Dakota v. Wayfair was a landmark case decided by The Supreme Court, which in a nutshell, mandated that states may collect sales tax from out of state sellers. With this decision, on-line giants like Amazon and eBay started collecting sales tax on all purchases, irrespective of which state the buyer was a resident of. Gone were the days where buyers could avoid paying tax simply by dealing with an out-of-state vendor. But, is this really the case? That is truly the million dollar question, and for much of the answer, the jury is still out. Obviously sales tax is a very complex issue, as certain items are subject to it, where other items are exempt. So, where do rare coins fall in this picture? Many states do in fact have numismatic and/or bullion tax exemptions (Refer to tables below). Unfortunately, online behemoth eBay has been very slow responding to this reality. Most buyers are reporting being charged sales tax, even those that live in tax-free states. Apparently, eBay has taken the position that it is better to be too cautious than the alternative. For the time being, this is causing us a major headache (and yes, a drop in sales, as well). The question becomes how should one proceed until eBay gets this issue straight? The answer is two-fold: First, we believe that Wayfair will serve as the precedent for all out-of-state internet purchases, and exemptions currently in place will probably disappear over time. But, we also believe that those policies and the enforcement wings are not in place yet, so there still is a tax-free window for many out-of-state purchasers. For the time being, WE STRONGLY URGE OUR EBAY CUSTOMERS TO BUY FROM US DIRECTLY. WE ABSOLUTELY WILL NOT CHARGE SALES TAX TO ANY OUT-OF-STATE PURCHASERS, EXCEPT IN THE INSTANCES THAT WE ARE REQUIRED TO DO SO BY LAW. Again, we do believe at some point all vendors, ourselves included, will be required to collect sales tax; but, we are not there yet. We will certainly keep our customers apprised of any developments on this evolving issue.